The BDS Index Fund, Revisited

Giving Credit Where It’s Due — and Why the BDS Index Fund Still Matters

Introduction: Turning BDS Lists into an Investment Idea

Recently, I published an article titled Investing in Hypocrisy: The BDS Index Fund.

That piece explored a counterintuitive idea: turning the BDS movement’s own boycott lists into an investment opportunity. By envisioning a “BDS Index Fund,” it exposed the hypocrisy of activists who denounce companies they secretly rely on, while highlighting how these same firms are among the most profitable and indispensable in the world. Equal parts financial analysis and sharp satire, the article showed how markets—and a little irony—can disarm ideological campaigns.

Credit Where It’s Due: Earlier “BDS Fund” Concepts

After publication, Ron Machol, COO of Zachor Legal Institute—an organization that uses the law to oppose antisemitism and the delegitimization of Israel—reached out to point out that Zachor had launched a similar concept in 2024: the Ma Tovu Fund. The fund’s Hebrew name comes from a blessing in the Torah, and in its inaugural year it posted an impressive 19.95% gain.

I also came across an earlier piece by Elder of Ziyon, Invest in BDS — Boycotted Companies Make Lots of Money, published in The Algemeiner in 2017. As the author quipped: “It is every investor’s dream to beat the market. Thanks to BDS, now we can!”

Had I known about Zachor’s Ma Tovu Fund and Elder of Ziyon’s BDS Fund article, I would certainly have referenced them in my original piece. That’s why I’m writing this follow-up—to give proper credit where it’s due.

Active vs. Passive: Why Structure Matters

It’s important to note that neither Zachor’s Ma Tovu Fund nor Elder of Ziyon’s BDS Fund are passive, cap-weighted index funds. Both appear to be “actively managed”—though still conceptual. That distinction matters because a true index fund is rules-based and transparent, directly reflecting the underlying boycott lists, whereas an actively managed fund relies on subjective selection.

In their own words:

Zachor’s Ma Tovu Fund:

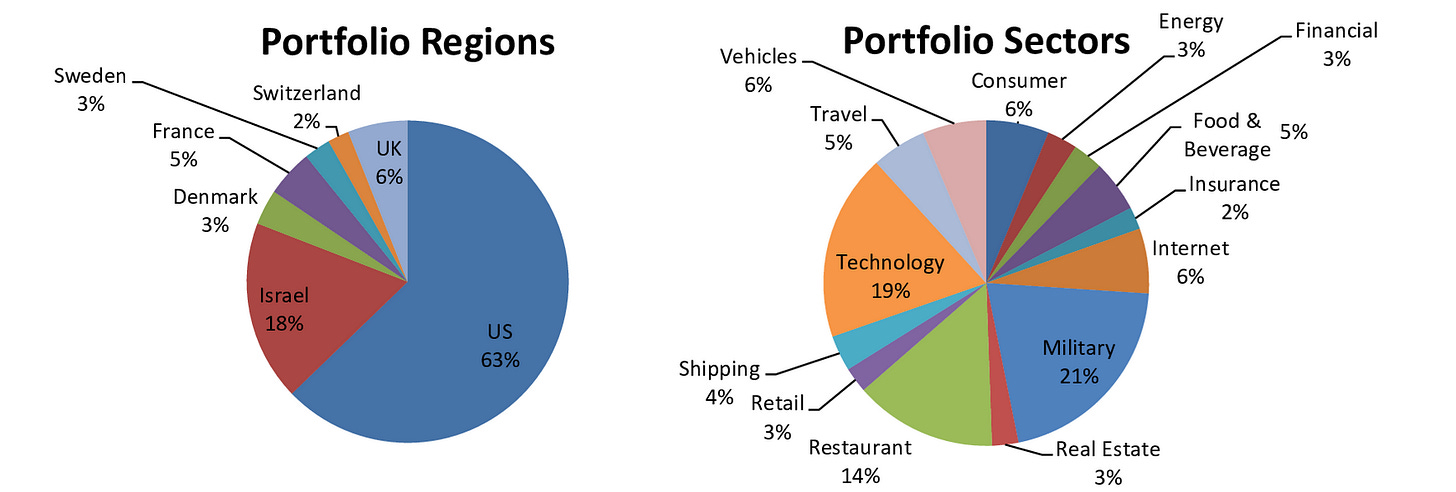

“The portfolio selects well-known companies that are being targeted for boycott/divestment, while ensuring a balance of sectors.”

Elder of Ziyon’s BDS Fund:

“If you would have invested equal amounts in all these companies a year ago, you would have made an astounding 50% profit. (The Dow Jones Industrial Average gained 16% in that time period.)”

Why the BDS Index Fund Stands Out

Unlike actively managed or equally weighted funds, the BDS Index Fund concept is the most direct and impactful. Its strength lies in both structure and name: a transparent, rules-based index that mirrors boycott lists themselves, paired with a blunt, unmistakable label.

Calling it the “BDS Index Fund” ensures visibility, clarity, and broad recognition—and, not least, it directly irritates BDS activists. If the term gains traction—or better yet, if an investment company creates a real mutual fund or ETF under that name—then the BDS movement won’t just face irony. It will face a powerful financial and rhetorical defeat.

And here’s the twist: what began as satire could, with little effort, become a real financial product.

Could the BDS Index Fund Actually Exist?

Although this idea began as satire, there is no structural barrier to creating such a fund in reality. Exchange-Traded Funds (ETFs) are routinely launched around narrow themes, including those driven by ethics, values, or even irony.

For instance, the AdvisorShares Vice ETF (VICE) targets alcohol, tobacco, cannabis, and gaming industries.

Faith-based investors have options like the Global X S&P 500 Catholic Values ETF (CATH) and the Wahed FTSE USA Shariah ETF (HLAL).

Political funds exist as well, such as the Point Bridge America First ETF (MAGA) and the Democratic Large Cap Core ETF (DEMZ).

A “BDS Index Fund” would fit this established pattern. The boycott lists already function as a transparent, rules-based index; a fund sponsor could package them into a portfolio; and regulators such as the SEC primarily review methodology, disclosure, and investor protections—not political framing.

In other words, a BDS Index Fund could, in principle, be registered, approved, and offered to the public just like any other thematic ETF.

A “Prestige Problem”: When Companies Compete to Be Boycotted

Ironically, if the BDS Index Fund ever gained real prestige, we might face a new kind of market distortion: companies trying to game their way onto the boycott lists just to be included in the fund. Imagine a tech giant proudly flaunting its business with Israel, hiring journalists, influencers, and content creators to “expose” its ties, or even lobbying BDS committees to secure a coveted spot.

In financial terms, it would be like a company clamoring to join the S&P 500 or a popular ESG (Environmental, Social, and Governance) fund—not because it improves operations, but because being listed becomes a badge of market desirability. Suddenly, ideological shame would transform into corporate bragging rights—and a profitable opportunity for savvy investors.

In the end, the BDS Index Fund could turn boycotts into a new form of corporate prestige—proof that irony, in the market, always yields returns.

The Financial Disclaimer: Satire Meets Reality

And finally, in my previous article, I neglected the financial industry’s sacred mantra: “Past performance is not an indicator of future results.”

So here’s my formal disclaimer, with all the gravitas it deserves:

I am not a financial or legal expert, I don’t play one on TV, and nothing here should be construed as advice. All information is provided purely for entertainment, at your own risk, and with zero guarantees of accuracy. Read, chuckle, and invest wisely—or don’t.

Conclusion: Irony as a Market Force

Ultimately, whether or not a “BDS Index Fund” ever hits the market, the exercise itself exposes the contradictions and hypocrisies of the boycott movement. By turning their own lists into a potential investment, we reveal that the companies BDS decries are not only indispensable to daily life but also engines of global economic growth. In other words, irony becomes a market force—and sometimes, that’s the most effective way to disarm ideology.